On May 21, 2025 the House Rules Committee amended H.R. 1, the One Big Beautiful Bill Act, to include Sec. 2 of the Constitutional Hearing Protection Act—fully removing suppressors from the National Firearms Act of 1934.

Sec. 112029 of the One Big Beautiful Bill Act eliminates the NFA’s excise tax and registration of suppressors. If the suppressor removal survives the rest of the reconciliation budget process, they would be treated as firearms subject to a NICS background check at point of sale, but not specialty handling and registration by BATFE and no NFA tax.

A statement by the Gun Owners of America (GOA) said, “Following the House’s passage of the One Big Beautiful Bill Act on May 22, the Senate has a historic opportunity to end nearly 100 years of unconstitutional gun control of common use items such as suppressors and short-barreled firearms during the upcoming budget reconciliation process.”

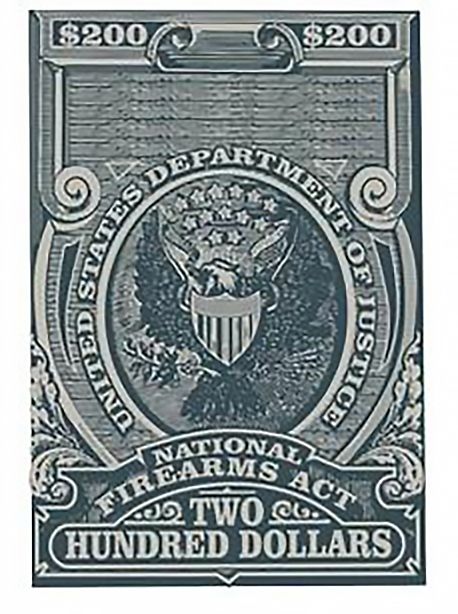

The National Firearms Act’s primary function is as a tax. The Supreme Court in Sonzinsky v. US (1937) explicitly ruled that the NFA didn’t cease to be a tax simply because it has secondary policy implications. Also, every subsequent federal court has also agreed that the NFA is primarily an exercise of Congress’ power to tax and that’s why it’s not unconstitutional under the Second Amendment.

GOA said that Congress’ claimed authority to regulate NFA “firearms” has always been a taxation regime. Without the tax, there is no mechanism to impose restrictions on the possession of these firearms. As part of the reconciliation process, it should therefore be possible to remove the $200 tax stamp and use conforming amendments to remove all documents related to the collection of this tax—like the registration forms.

A tax and registration requirement does not apply to 1st amendment speech, so why is that justified to interfere with a 2nd Amendment right? It’s not justified. Taxation is in fact a method of control not just raising revenue. Remember the $200 dollar tax in 1934 was a month’s wages for many blue collar workers. In today’s dollars that inflation adjusted amount would be $4,787.99.

How many of you would buy a suppressor today for $600 plus $4,787.99 ???

We’re lucky the cost of the tax hasn’t followed the rate of inflation since it’s inception. As someone else mentioned, if it had that little stamp would cost you over $4000. Suppressors should have never been put on the NFA hit list to begin with. Serialization should be sufficient enough to track sells, just like firearms. I’ve got 4 stamps and a small fortune in lawyers fee’s just for the rights. Ridiculous!