Excise taxes paid on sporting firearms, ammunition and archery equipment in 2009 contributed a record nearly $336 million, according to the U.S. Fish & Wildlife Service.

These contributions are the result of the Pittman-Robertson Wildlife Restoration Act, passed in 1937, which directs funds to states based on land area and paid hunting license holders, among other criteria. And while there is always a temptation for governments to redirect funds, legislative safeguards prevent these Wildlife Restoration monies from being diverted away from state wildlife agencies.

In making the announcement, Department of the Interior Secretary Ken Salazar said, “These investments, which help create jobs while protecting our nation’s natural treasures, are particularly important in these tough economic times.”

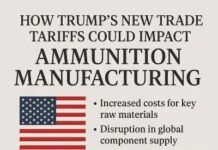

Legislation introduced earlier this year by Rep. Ron Kind (D-Wisconsin) will allow the industry to pay the firearms and ammunition excise tax (FAET) on a quarterly basis, the way other industries that support conservation do. Currently firearms and ammunition manufacturers must pay the FAET bi-weekly, a schedule that forces many manufacturers to borrow money to ensure on-time payment.